By Matthew Miles, Product Development Manager, Dynisco

American companies take many different paths when faced with the need to significantly reduce costs and improve profits. One long-term trend has been to move product manufacture and assembly from the U.S. to a foreign, low-cost labor geography. Before making a move of this type, however, it is worth considering some proven methods that can help your company understand whether the payoff will measure up to expectations. Total Cost of Ownership (TCO) and Design for Manufacture and Assembly (DFMA®) are two tools to consider for analyzing product costs in order to make data-focused decisions with the best interests of the company in mind.

TCO is a costing tool used to understand direct and indirect costs of building products at different manufacturing sites. Typically a strategic sourcing decision tool, TCO is employed by Dynisco to do just that and identify the optimal build site for a product. Running a Total Cost of Ownership (TCO) analysis before offshoring can reveal hidden costs in the production move that could offset the anticipated savings. Our TCO structure is native to Dynisco and integrated with our DFMA software. However, a free TCO spreadsheet is readily available from the Reshoring Initiative. www.reshorenow.org.

DFMA is a product costing and simplification software from Boothroyd Dewhurst Inc. (BDI), Wakefield, R.I., in use at Dynisco since 2009. The software has two modules, Design for Assembly (DFA) and Design for Manufacture (DFM). DFA is used to analyze product bill-of-materials by applying industry-tested minimum part count criteria to find parts that can be consolidated or eliminated while maintaining 100% product functionality. Improvements made with DFA typically result in fewer parts, easier assembly, and cost reduction. DFM is used in parallel with DFA to understand the costs of the product’s individual manufactured piece parts. Collectively, DFMA is used in new product development (NPD) and to cost-reduce existing manufactured products.

As Dynisco’s VAVE (Value Analysis / Value Engineering) Engineering Manager, I have used TCO and DFMA to analyze multiple types of industrial products for determining optimal build sites and NPD/cost reductions. We recently completed a TCO and DFMA analysis on an existing product, currently built in the U.S., to determine whether we should move it offshore to a lower-cost build site, as well as look for opportunities to cost-reduce the product. The following summary will walk through our analysis steps to show how we applied TCO and DFMA to this product, which, after a full accounting analysis and redesign, remained at our U.S. manufacturing site with an 8% cost advantage over Asia. (The options were to keep production in place or move to build sites in either China or Malaysia.)

Real-World Product Example

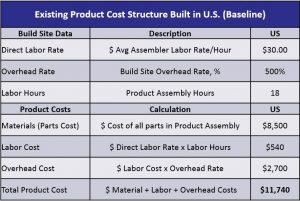

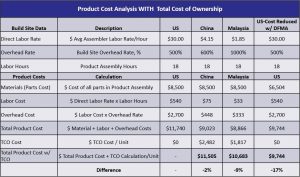

Management at a sister company in the Midwest, for which my group provides VAVE support, requested an analysis in 2015 on a test instrument used for analyzing material during processing. The product can be described as low in annual volume and has over 800+ parts in the assembly. Its baseline cost structure is shown in Figure 1. Using representative numbers, the U.S. labor and overhead rates are shown along with the assembly time. The calculations for labor and overhead costs applied to the product are also shown in the chart. These costs are added to the materials (parts) costs resulting in the total product cost.

Fig 1. Data of the existing material-analyzer product-cost structure, as manufactured in the U.S. before analysis. The baseline numbers are representative, not actual numbers.

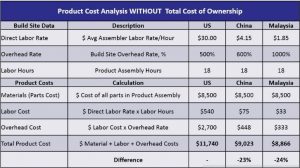

After looking at the existing product costs, we then estimated what the labor and overhead costs would look like at the overseas facilities based on their labor and overhead rates. Figure 2 shows the much lower labor rates and costs at the China and Malaysia build sites. While the overhead rates are higher, applied overhead costs are a function of the labor cost and are also much lower. This estimate assumes no change to labor hours or materials costs for the product. Based on the differences in total product costs, it’s easy to see how one might think this is a non- decision to make, but this is where a TCO analysis comes into play. TCO will account for costs to move and support production as well as other hidden costs to sustain the product in a new location.

Fig 2. Total Product Cost at overseas facilities compared to the baseline data and before performing the TCO analysis.

TCO Analysis Defined

Before looking at the TCO results, let’s first define what cost data TCO is essentially providing by describing the method that Dynisco uses. Again, TCO can best be defined as a strategic sourcing decision tool that can be applied either to product assemblies or to individual parts. TCO costs are calculated based on a combination of hard, known data and well-informed estimates about the product or part. Commonly calculating in Excel, Dynisco also has a custom-built TCO operation in the DFA software that uses some of the same product data already entered into a DFA analysis. For the example product in this discussion, the following inputs were applied.

First, each build site to be compared for TCO costs—typically between two to four sites—is labeled in its own column for quick comparisons of each input and result. The product’s annual volume and site-specific lead time are entered followed by the site labor rate, the total assembly time, total material costs, and total overhead. Next, what is called the “total landed cost” is entered for each site. Total landed cost is defined as the cost of shipping/freight, insurance, and duties from each site.

Rounding out the remaining TCO inputs are the cost of poor quality (COPQ), build-site profit, inventory carrying costs, reoccurring costs, and one-time transition costs. COPQ, build-site profit, and inventory carrying costs are percentage estimates that are calculated against the total product cost at each site and added to the total cost in terms of cost per unit. Reoccurring costs are defined as the travel expenses for sending engineers or other company personnel overseas to support the product. Flight costs add up quickly if, say, an engineer has to fly three or four times a year from the U.S. to the Asia region. Lastly, one-time transition costs are defined as the tooling and equipment cost required to set up assembly cells overseas, for example.

The final piece of the TCO analysis is the input called “risk factor.” Dynisco uses 17 different risk factors that are assigned a weight of impact and probability of occurrence. Examples of risk factors are inflation, quality (losing the design “recipe”), currency differences, and intellectual property (IP) transfer. For instance, one build site might assign IP transfer at the highest weight of 17 with a 100% probability of occurrence. The risk factor for IP transfer would equal 17%. The remaining 16 risk factors are then handled in the same manner until all have their own risk-factor value. The average percentages of these seventeen risk factors are then multiplied with the total product cost for the risk factor cost per unit.

It’s important to note that Dynisco’s method calculates the TCO costs for one calendar year. Subsequent years can be copied over and the inputs modified based on how production changes from year to year. Perhaps travel costs are reduced and transition costs eliminated from the first year of moving a product versus additional years. For example, Dynisco has for some cases estimated the TCO costs for the first five years of a product’s assembly to chart estimates for sales volume versus revenue or annualized savings.

TCO Analysis Results

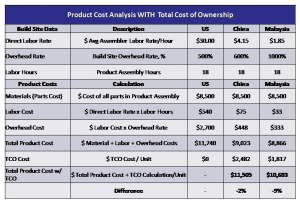

Now that the TCO calculation has been defined, let’s look at the year-one TCO totals for the example product. Figure 3 shows the TCO costs per unit if the material analyzer were moved to the China or Malaysia build site. When we compared the product labor and overhead costs in China and Malaysia to the baseline costs, there is was an estimated cost savings of -23% and -24% per unit, respectively. Adding in the TCO costs, though, shows that the year-one anticipated savings per unit drop to only -2% for the China site and -9% for the Malaysia site. Based on those numbers, it might still be appealing to go after the 9% savings by moving production to Malaysia. However, the VAVE group has become quite accustomed to analyzing products with the DFMA software and, on average, identifying cost-reduction opportunities that surpass 9% of the total product cost. The next section will review what the DFMA analysis uncovered.

Fig 3. Total Product Cost at overseas facilities compared to the baseline data and before performing the TCO analysis.

DFMA Application

Boothroyd Dewhurst’s DFMA software is used for product simplification and cost improvement by many companies. In their experience, they have seen the typical product cost breakdown into the following averages; 72% parts, 4% labor, and 24% overhead. Dynisco can support this, as we have sampled some of our own products and showed an average cost breakdown with similar percentages. For instance, the example product’s cost breakdown was 72% parts, 5% labor, and 23% overhead. This is why, as practitioners of the DFMA software and philosophy, we focus cost improvement efforts on where the majority of the product costs lie: within the parts.

The DFMA process starts by entering a product bill-of-material with part costs into the DFA software. From there the DFA user will input the product structure in order of assembly to the best of their knowledge. This requires putting the parts, subassemblies, and additional operations in an assembly structure for the analysis. The minimum part criteria questions are answered for every part in the product assembly. A base part is assigned and then, for each part added to the assembly after the base, the DFA user answers the following three questions in relation to all other parts before it in the assembly: 1. Does the part move relative to all other items? 2. Must the part be a different material? 3. Does the part have to be separate to allow assembly? If a part does not meet any of the three minimum part criteria questions, it is considered a candidate for elimination.

These questions make up the DFA theory/philosophy that is the catalyst for engineers to generate the discussions that come up with ideas on how to combine parts for function or eliminate them altogether from the product assembly. Handling- and insertion-difficulty questions are answered as well, while all along in the background the DFA software is estimating assembly time based on the size of each part, subassembly, and overall product assembly. DFA is creating a virtual product-assembly cell and routing estimate for the user based on all of the analysis inputs. The goal with DFA is to minimize the total number of parts, improve ease of assembly through labor time reduction, and ultimately minimize product cost with this approach.

The DFM side of the software is then used to analyze the “should-cost” of parts in the product assembly. DFM provides detailed manufacturing cost estimates for a variety of material and process combinations. Used on existing production parts, the DFM cost estimates can then be compared to supplier costs to determine what the company “should” be paying. When applied towards newly designed parts, DFM provides an early cost estimate for engineers at an important phase in product development.

A full DFMA baseline analysis was conducted on the material analyzer to identify opportunities for cost reduction to compliment the TCO analysis. A two-day workshop was also conducted between my VAVE group and fellow engineers from our sister company using the DFMA tools. Together we reviewed the baseline analysis and brainstormed for cost reduction ideas. The DFA analysis on the 800+ part assembly identified over 100 parts that were categorized as candidates for elimination. DFM was used to analyze over 50+ manufactured parts that made up almost 40% of the material costs and found that the should-cost estimates were 32% lower than the supplier prices. This means there is ample opportunity to work with suppliers to identify cost drivers and partner together to look for ways to lower manufacturing costs. Overall, the DFMA effort showed there was potential for 15%+ opportunity in cost reduction on the product through DFA design improvements, labor time reduction, and capitalizing on the DFM data, all without moving to another build site.

Data-Based Decision

Again, the goal of performing the TCO and DFMA analysis was to determine if this product should be built at one of our low-cost manufacturing sites overseas for cost reduction and identify opportunities to reduce the cost of the product from the design perspective. Figure 4 shows the final analysis summary for all of the steps taken in order to make the final decision.

Fig. 4. Cost breakdowns of manufacturing in the U.S., China, and Malaysia compared with the product cost after DFMA analysis.

Based on our TCO and DFMA analysis, the decision was made to keep the product at the current U.S. build site. The TCO analysis determined that the year-one cost savings would only be 2% or 9% lower than the baseline or existing build site. Collectively, two major items factored greatly in the decision. IP transfer was a risk the company was not willing to take from building in another country and the DFMA analysis showed the potential for greater than a 10% cost reduction over the next year. Therefore, sustaining activities— such as implementing to production the cost-reduced design changes and labor time improvements identified in the DFMA workshop— have begun to cost-reduce this product.. The end result: A 17 percent baseline improvement by continuing production in the Midwest—8 percent more cost-effective than Malaysia.

Trust the Tools

As I mentioned at the outset, companies have a wealth of options when it comes to what particular engineering, supply chain, and operations methods they choose to reduce costs, increase profits and sustain their domestic manufacturing assets. No matter what is chosen, one thing is central: finding the people who can become the subject-matter experts and help develop project teams to correctly use tools such as TCO and DFMA. Our advice is to encourage and deploy people who can work with finance, purchasing, engineering, and other departments to gather data and share ideas and opinions on the various costs that go into making the target product.

Through my experience, I advocate a top-down approach for implementing programs such as these. Strong support from upper management is critical. Grass roots initiatives at a company, while noble, are slower and more difficult. Still, finding opportunities to present analysis results and benefits from these programs to cross-sections of the company is important towards building buy-in from others for either approach to implementation.

A further note: strategies such as TCO, DFMA—and even Value Engineering—need to be viewed and applied more broadly than they are now. Mention one of these tools and the first thought by engineers and managers is often that they are for “special cost reduction” situations or are the “ideal” only, for use exclusively by the VAVE team. But any DFMA, TCO or Value Engineering veteran will tell you that these are everyday tools that can be an important part of product development. These programs are really about optimizing product costs while maintaining function and quality. Yes, the techniques are also valuable for legacy parts, but their biggest value is realized when put into play right up front, and used every day.

Building Where You Sell

One of the most unfavorable impacts of building parts and products away from home—and a frequently overlooked point when deciding to do so—is its effect on continuous improvement. For most US-based companies, the engineering team is still in the States. That presents solid opportunities for TCO organizational collaboration and DFMA workshops and brainstorming sessions that otherwise wouldn’t take place when working across multiple time zones. Moreover, anytime a product design is modified, new quotes from suppliers and additional DFM on downstream parts are likely required. Issues crop up here that would be difficult to resolve without an engineer or product designer onsite, too. The product development process as a whole is far more manageable if done in-house, we have found. It is often easier and more profitable to serve a major market such as the U.S. from a headquarters and plant within that market, as Dynisco will do with its test instrument.